-07ec0717-4a47-4173-adf9-b2527ce89549.png)

Description

The ABBA Check Reader Platform is a cutting-edge technology that plays a vital role in modern banking and financial services worldwide. It offers comprehensive image analysis and intelligent recognition software, setting a global standard for the efficient and secure processing of checks and various payment documents. Its advanced features help financial institutions and businesses increase efficiency, reduce fraud, and provide convenience to customers.

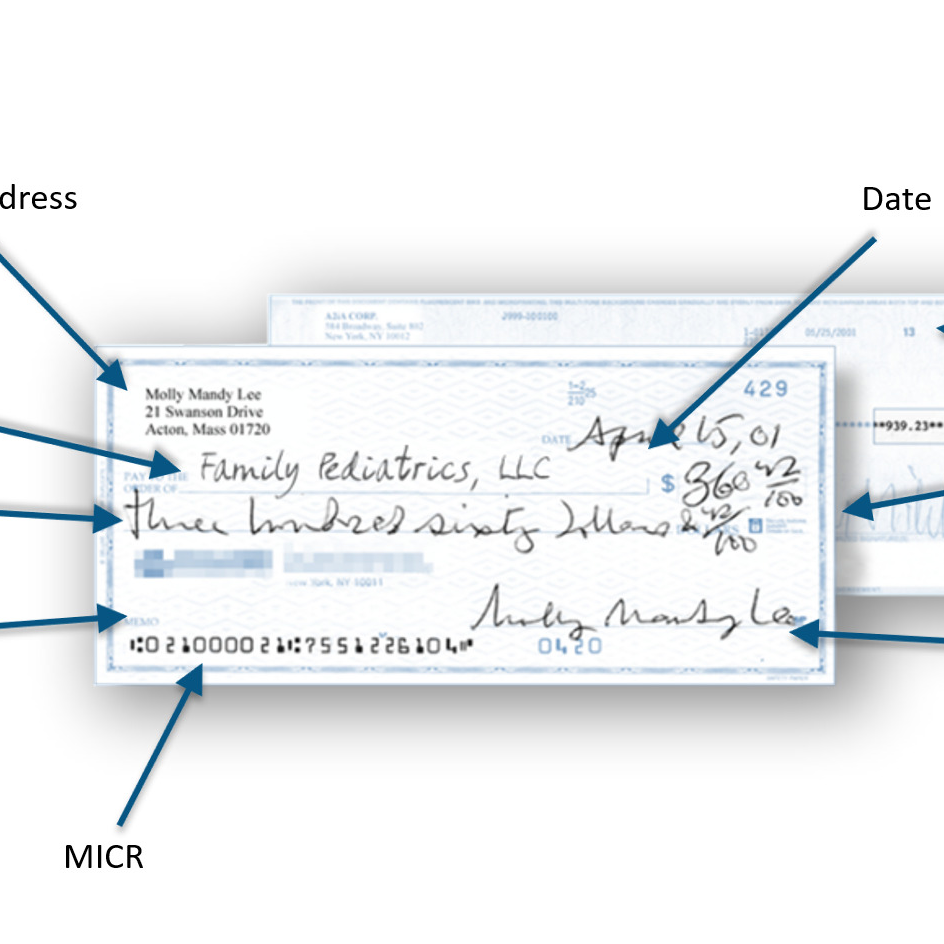

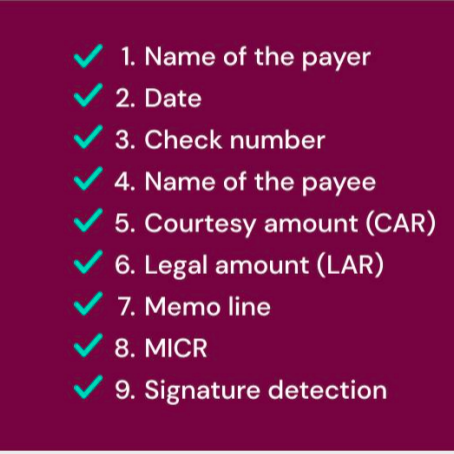

The platform employs a three-pronged approach, utilizing OCR (Optical Character Recognition), ICR (Intelligent Character Recognition), and IWR (Intelligent Word Recognition) technologies. This enables the system to quickly and accurately identify critical payment information, including handwritten words and individual characters, whether handwritten or printed. By capturing and recognizing data from every payment, ABBA Check Reader ensures smooth and precise transaction processing.

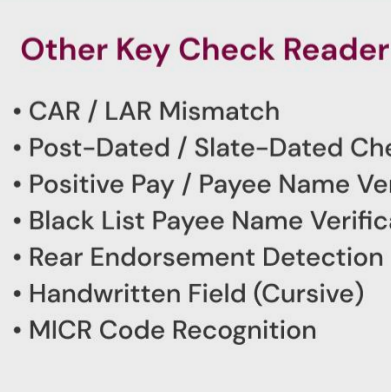

One of the platform's key strengths is its ability to detect fraudulent activities, safeguarding against potential threats in the payment ecosystem. Additionally, it assesses image quality and availability, ensuring that payment documents are processed effectively.

ABBA Check Reader leverages the latest advancements in machine learning, particularly deep learning, to continually improve its recognition capabilities. With its widespread adoption in various industries, the platform has become an indispensable tool for financial institutions and businesses globally, contributing to streamlined operations, enhanced security, and overall customer satisfaction.

Pricing Options

- Monthly subscription

- One time license

Targeted Customers

- Insur Tech

- Software Tech

- Government Agencies

- Medical and Rehabilitation Centers

- Check Verification and Validation Services

Solution Type

- Product

- Application

Customizable

Customizable according to the customer´s needValue proposition

- Efficient processing of checks and payments.

- Advanced fraud detection capabilities.

- Comprehensive recognition of printed and handwritten data.

- Streamlined operations with automated processing.

- Enhanced customer convenience and satisfaction.

- Utilizes cutting-edge machine learning for continuous improvement.